They set a 50-pip stop loss and are trading EUR/USD, where the pip value for a standard lot is $10 per pip. For example, when trading EUR/USD with a standard lot, each pip movement equals $10. If a trader uses a mini lot (10,000 units), the pip value drops to $1 per pip. In forex trading, leverage and margin work together to determine how much capital a trader needs to control a given position.

Accurately Estimating Profit Potential

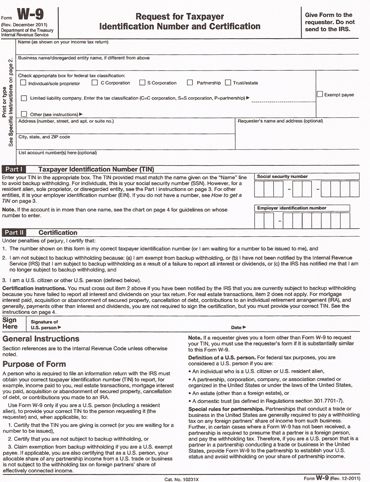

Knowing how to calculate the lot size of a trade is essential for managing risk. The calculation depends on your account size, risk tolerance, and the instrument or currency pair you’re trading. Employing the correct lot size helps you manage forex risks and protect your capital. When determining the lot size to use, consider how much you have in your trading account, your risk tolerance, and your trading strategy. As an active Forex trader, you know how crucial it is to use proper position size Forex leverage and manage your risk. However, determining the right lot sizes in Forex can be confusing with all the varying Forex leverage and lot size options.

- Common errors include overleveraging capital, skipping a risk management plan, neglecting diversification, and failing to adjust positions during market changes.

- Samuel is scheduled to conduct a video news conference with Washington reporters Thursday.

- Furthermore, margin requirements, potential profits, and losses are all tied to the lot size chosen.

- Moreover, if you use a higher lot size and have less capital on your account, it is more possible to end up with empty hands than to have any profits.

- 0.01 is a micro lot and represents 1,000 units of a base currency in forex.

By factoring in your stop-loss level, you can adjust your trade size accordingly to maintain an appropriate risk-reward ratio. Understanding lots and position sizing is a fundamental skill in managing risk and the benefits of forex trading optimizing trades. Position sizing and lot size directly impact how market price movements affect your trading account. Calculating the proper sizes is crucial; too large and you risk exposure to significant losses, too small, and potential gains may be minimal. There are various position sizing models that traders can utilize to adjust trade size based on market conditions. One popular model is the Fixed Fractional method, where you allocate a fixed percentage of your trading capital to each trade.

As you can see, the smaller the lot, the less a one-pip movement costs. In turn, that means you can have a smaller outlay by trading smaller lots. Lots are subdivided into four sizes – standard, mini, micro and nano – to give traders more control over the amount of exposure they have. It signifies the specific quantity of an asset or commodity that can be traded in the market. Highly correlated assets may require smaller individual trade sizes to prevent overexposure to a single market trend.

Adapting To Account Growth

This includes determining the maximum percentage of the account to risk on a single trade and the overall risk tolerance for the portfolio overall. In forex, a lot size in forex refers to the number or amount of currency you buy or sell. It represents a standardized quantity of a currency or, simply, the transaction amount. So, when you take a trade, orders are executed in these transaction sizes, referred to as lots. Rather than manually plugging in the variables each time, I recommend using an online Forex trading lot size calculator or position size calculator Forex to simplify the process.

- This means, at the current price, you’d need 130,000 units of the quote currency (USD) to buy 100,000 units of EUR.

- It’s useful in mean-reversion strategies or when a trader has a strong belief in an asset’s fundamental value.

- The Optimal f Method is a position sizing strategy that revolves around the concept of allocating a fraction of your trading capital to each trade.

- It is important to use position sizing calculators and risk management tools to ensure that the trade size is appropriate and within the trader’s risk tolerance.

Example of Trade Size Scaling

If your account grows to $12,000, the position size for new trades would increase to $240. This adaptability is beneficial as it allows you to scale your trading as your capital and confidence in your strategy grow. Trade size is the amount of currency being traded in a forex transaction. It is expressed in terms of lots, which is a standardized unit of currency used in forex trading.

At the time, China was the primary trade partner for only a handful of countries, including Cuba, Iran, Libya, Myanmar, Mongolia, North Korea, Oman, Sudan, Tanzania, and Vietnam. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. All content on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalized advice before you make any trading or investing decisions. DayTrading.com may receive compensation from the brands or services mentioned on this website.

Micro Lot Size

As you can see, calculating position size properly using the right lot size is critical, especially when using leverage. That’s where lot size Forex calculator come in handy to help determine the optimal size based on your account size, risk tolerance, and stop loss. Whether you need to learn how to determine lot size in Forex for your next trade or want to learn more about calculating lot size Forex, you’ve come to the right place. I’ll explain lot sizes in Forex in simple terms so you know exactly how to use leverage and position sizing together for smarter risk management. That’s why I’ve created this handy web page with a free Forex lot size risk calculator for you to use.

Both strategies can be risky and are generally not recommended for most traders. This is important in volatile markets or when dealing with high-risk assets. Click here to visit eToro to sign up and try out their innovative platform.

Furthermore, margin requirements, potential profits, and losses are all tied to the lot size chosen. A larger lot size means greater potential profits, but also higher risk. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

A lot in forex trading is a unit of measurement that standardises trade size. The change in the value of one currency compared to another is measured in pips, which are the fourth decimal place and therefore very tiny measures. This means trading a single unit isn’t viable, so lots exist to enable people to trade these small movements in large batches. To trade currency pairs, you need to understand the concept of a lot in forex.

Continuous education, backtesting, and possibly paper trading can help refine scaling techniques and improve overall trading performance. These can help automate the process and make sure there’s consistency in applying the chosen scaling method. These are more aggressive scaling methods that also started within gambling contexts. They might start at 0.5%, for example, then add as the price falls (if applicable), but cap out at a 1% sizing. For example, if you want to trade the EUR/USD pair, you would select «EUR/USD» from the instrument dropdown menu. Understanding market timing and developing a robust exit strategy are critical components of…

Without a clear grasp of how contract size and lot size function together, traders risk miscalculating position sizes, leading to excessive exposure or missed opportunities. A thorough grasp of contract and lot sizes forex pairs enables traders to adapt to market conditions. When volatility increases, traders may choose smaller lot sizes to reduce exposure.

Do All Forex Brokers Offer the Same Lot Sizes?

This mitigates the damage that a series of losing trades can inflict on CFD Trading your account. For example, if you experience a 10% drawdown, your position size is adjusted accordingly to limit the impact on your capital. The size of a trade can greatly influence a trader’s emotions and decision-making process.