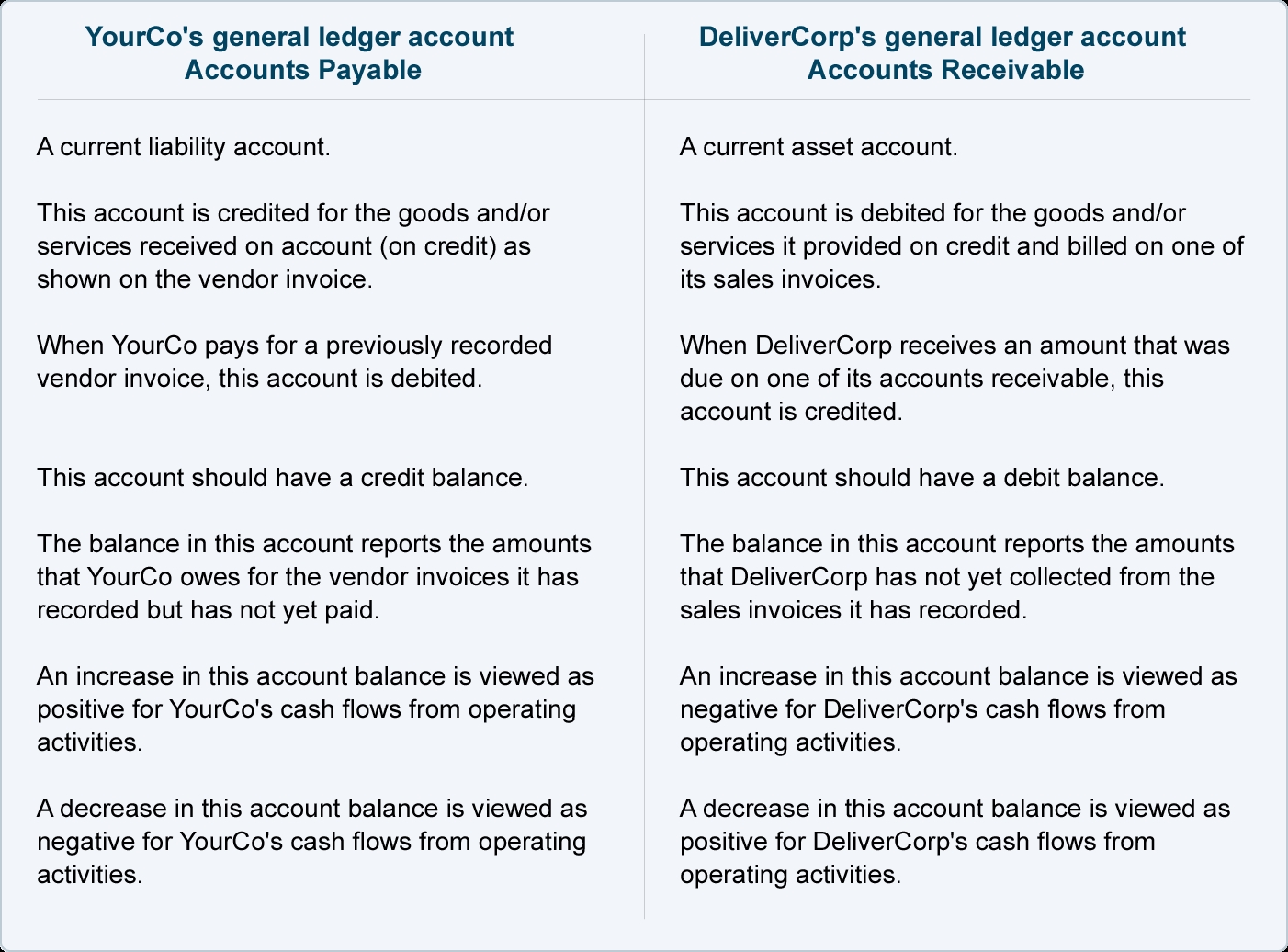

Since no taxes are taken out of your income, quarterly tax payments also mean you won’t owe a lot of money at the end of the year. Sole proprietors need to report their business income and expenses by filing the Schedule C form along with 1040. Business profits and losses listed in Schedule C are transferred to your personal tax return. The Schedule SE form must also be filed, which calculates how many taxes you owe in self-employment taxes. As a sole proprietor, you are personally responsible for all your business debts and obligations, including loans, leases, credit accounts and lawsuits. Liability insurance can help to some extent, but if you are concerned about the risk to your personal assets if your business fails or is sued, an LLC or corporation may be a better choice.

This is one of those sole proprietorship examples that will grow certainly in 2023. However, since their work will have an effect on their clients’ health, people need liability insurance. Make sure to research the laws in your state before starting your business, especially if you intend to work from home. We explain various alternative options of financing in this article that may be useful in case you start a sole proprietorship. Customer Suzy slips in the puddle and falls, striking her head on the arm of a chair. Continuity – A sole proprietorship lasts as long as the owner wishes.

HOW TO SET UP A SOLE PROPRIETORSHIP

A sole proprietorship is an unincorporated business with only one owner who pays personal income tax on profits earned. If your business has a single owner, you will need to decide whether to form a sole proprietorship or S Corporation. If you do not incorporate as another entity type and are running your business on your own, your company is a sole proprietorship by default. An accounting company provides for the financial requirements of other companies. Revenue, costs, and other financial information are entered by a bookkeeper into an accounting information system. This provides business owners with reliable financial data about their companies.

- As such, these types of businesses are very popular among sole owners of businesses, individual self-contractors, and consultants.

- A sole proprietorship is a business that is owned and operated by a single individual.

- Usually, when a sole proprietor seeks to incorporate a business, the owner restructures it into an LLC.

- With an LLC, you will have strong personal liability protections such as corporations and beneficial taxes like a partnership.

As mentioned above, you can conduct business under your own name or business name you choose without it being official. However, if you choose to file your own business name, very little paperwork is required. K.A. Francis is a freelance writer with over 20 years experience, and a small business consultant and jewelry designer. She holds a Bachelor of Arts in English and business administration and a Master of Arts in Adult Education.

Often, graphic designers are employed by the marketing department of a company, but you may also create a separate legal entity for yourself. You will be writing the content on your own, without working with anyone else, which makes it the perfect example of a sole proprietorship. People with this small business ownership type have a difficult time when it comes to finding investors.

Can you convert an LLC to a sole proprietorship?

period costs Know-How Browse hundreds of helpful articles on everything business. Julia is a writer in New York and started covering tech and business during the pandemic. The designation is automatic and kicks in as soon as you start doing business. Starting a business as a housekeeper means finding homes to clean and establishing a regular list of clients. This can be difficult to do on your own, but you also aren’t likely to need to pay for help right away.

Sole proprietors often face challengeswhen trying to raise moneybecause they cannot sell stock in the business, which limits investor opportunity. Banks are also hesitant to lend to a sole proprietorship because of perceived additional risk when it comes to repayment if the business fails. A sole proprietorship is an unincorporated business owned and run by one individual with no distinction between the business and the owner. If you take on a business partner, your unincorporated business will become a general partnership.

Converting a sole proprietorship to an LLC requires you to file articles of organization with your state secretary. Also, you will have to refile your “doing business as” to keep your company name. A sole proprietorship is best suited to small businesses with low risk and low profits.

- Many sole proprietors seek to benefit from this stability by starting home healthcare businesses.

- The owner is not required to formally register their business with their state as corporations or LLCs do.

- Whichever business structure you choose, it’s always smart to research what works for other successful business owners.

- Accounts receivable financing and unsecured loans can also be costlier loan options.

- While sole proprietors are not required to file a separate business tax return, they are required to report their business activities on a separate schedule to their personal tax return.

Due to the time and the effort, proprietors may wish to pay for specialized software and advisors to streamline the time spent on administration. Tutoring businesses provide learning assistance to students in a variety of subjects. Tutors may work with students in person or through online video chats. Many tutors have teaching experience or extensive knowledge in the subject they are teaching.

However, many sole proprietors use a trade name for marketing purposes or to keep their personal identities separate from their business. If you plan to use any name other than your personal name, you’ll register a DBA name. For instance, Jane Smith doing business as “The Wedding Seamstress.” You are still operating as a sole proprietor but choosing to run your business under your business name. Make sure that no other business has your name by doing a search within your jurisdiction. If your sole proprietorship owns real estate, land, or any business property, you may be required to pay property taxes.

This way, you can build your brand while reaping the pass-through tax advantage of sole proprietorships. Sole proprietors don’t have to worry much about how they file taxes. Those with this type of business will only need to file form 1040 for individual tax returns, and then Schedule C for profits and losses. Most people looking to have their own business usually start by looking at some sole proprietorship examples. After all, when you don’t know what to do as a startup, looking at what other people did before you can give you a couple of ideas. Accounting services that involve bookkeeping and tax preparation are very popular and profitable.

Contents

Similarly, you may face a penalty for any IRS business form that you don’t file completely by the deadline. If you want to make sure you maximize your sole proprietorship tax deductions, we recommend working with an accounting pro. Users of the accounting software Bench can be paired with a professional bookkeeper who can handle all their tax filing needs. Additionally, it’s important to note that although you can deduct your business expenses, not all of them correctly reported on your profit and loss statement are 100% deductible.

5 Types of Entrepreneurship With Real-World Examples — The Motley Fool

5 Types of Entrepreneurship With Real-World Examples.

Posted: Fri, 05 Aug 2022 07:00:00 GMT [source]

Maybe you still have a full-time job and want to freelance on the side, render a service or sell a product. As long as you are the only owner you do not have to take formal action to form a sole proprietorship. As with all businesses, however, it is important to obtain any necessary licenses and permits needed to operate. One of the newest, most popular types of business entity is a limited liability company . LLCs are governed by state not federal law, and the owners of the LLC will need to decide how the company will be treated for tax purposes. With an LLC, you will have strong personal liability protections such as corporations and beneficial taxes like a partnership.

House Cleaning Services

Essentially, you set up a sole proprietorship simply by conducting business if you are the only “owner.” It is not necessary for you to take legal or formal steps to establish a sole proprietorship. You need to find out the regulations from your state’s health department. But other than that, it should be easy to set up a sole proprietorship and bring some business income your way. As long as you have a license or some sort of certification for your practice, you may set out as an unincorporated business.

What Is A Disregarded Entity? – Forbes Advisor — Forbes

What Is A Disregarded Entity? – Forbes Advisor.

Posted: Mon, 12 Dec 2022 08:00:00 GMT [source]

As a sole proprietor, you will report your business income and expenses on Schedule C of your personal tax return. When it comes to your sole proprietorship taxes, therefore, you’ll want to keep these special and sometimes overlooked business tax deductions in mind, as they can make a huge impact on your tax liability. There areover 23 million sole proprietorships currently operating in the United States, making it by far the most popular form of business entity.

Schedule SE

This is a great option for someone who pays personal income tax, with no legitimate ability to claim business expenses. Graphic designers create marketing materials, such as flyers, brochures, and logos for businesses. Most graphic designers, when not employed by a marketing or advertising agency, offer their services as freelancers and operate from home. This is why a sole proprietorship works well with their business needs for licenses and tax advantages. In this article, we’ll focus on a few examples of sole proprietorships for self-employed individuals, independent contractors, and freelancers. As a sole proprietor, all of your business’s income is considered your personal income.

Sole proprietorship taxation is different from other business entities, like corporations, because the business itself is not taxed separately from the business owner. Instead, you report and pay your sole proprietorship taxes as part of your personal tax return. A sole proprietorship is the simplest and least expensive small business structure to establish.

For the latest updates, news blogs, and articles related to micro, small and medium businesses , business tips, income tax, GST, salary, and accounting. With thousands of individuals selling anything from diet drinks to beauty items, direct sales is a multi-billion dollar business. The majority of sales representatives or direct sellers are freelance contractors, which means that even if they are connected to a much bigger company, they are responsible for their individual taxes and invoicing. If you’re actively involved in your business’s operations, then you will answer “yes” to this question. If you are an investor, or if the income from your business is passive in nature, consult with your accountant about how to proceed with your tax return. With this in mind, if your business is an LLC and you’re unsure of what your tax status is, you’ll want to consult with your business accountant or attorney, especially if this individual helped you form your LLC.

In fact, starting a sole proprietorship is so easy, many people have such a business without even realizing it. For instance, a freelance graphic artist working from home technically owns a sole proprietorship. Most business owners start their solo career as sole proprietors, as it gives them tax advantages and the ability to do their own work, at their own pace.

7 Partnership Advantages In 2023 – Forbes Advisor — Forbes

7 Partnership Advantages In 2023 – Forbes Advisor.

Posted: Fri, 21 Oct 2022 07:00:00 GMT [source]

Also, it’s common for partners to disagree on important issues, which can result in time-consuming and expensive lawsuits. To avoid disagreements that result in lawsuits, you should consider writing a partnershipagreement. Capital losses can be carried forward or backwards, offset against other types of income, or both during tax season. As a result, a sole proprietorship that has recent losses may be able to offset such losses against personal income.

Tutoring Services.

You are still responsible for paying taxes on the profits from selling the company’s products. If you complete work for businesses but are not an actual employee of these companies, you are considered self-employed and therefore a sole proprietor. Many hobbyists can also become sole proprietors if their hobby becomes popular and they find themselves filling orders.

Another important factor is taking full responsibility for one’s actions. One of the key draws of individual entrepreneurship is the temptation of total control. For tax considerations, you should consult an accountant to determine which structure is best for your new company. On-location photo shoots for occasions such as marriages and other special events are offered by independent photographers, who may work from their homes or from a studio. Many independent photographers launch their careers with nothing more than a camera, a laptop or desktop, and a vehicle to bring them to the venues. This kind of small-business proprietor can file for a «Doing Business As» name and deduct business costs because they are a sole proprietor.

Because it is unincorporated, the owner of the business and the business entity are considered one person by law. A sole proprietorship is a business structure where the owner is also the sole employee of the business. As opposed to operating under a company name, it gives owners complete control over the financials and everything related to the day-to-day operations of their business.

A benefits package offered in such a W-2 position might include an annual amount of paid time off, sick days and family leave. In contrast, when you are self-employed, if you don’t turn in the photos you retouched or make that handmade item to sell, you cannot invoice for your services or goods and money will not come in. For example, many sole proprietors navigate these disadvantages by seeking business mentors and alternative funding, establishing contractual agreements, tapping into tax breaks and saving for rainy days. They normally work alone, but if they need help with something outside of their area of expertise, they can readily recruit independent freelancers. Another excellent career path for sole proprietorships because there is no real obligation attached to the work. An individual franchisee is recognized as an example of a sole proprietorship for the purposes of taxes and other financial obligations.