Held-to-maturity securities are debt instruments that a company intends and is able to hold until maturity. These are recorded at amortized cost, reflecting the intention to earn interest income over the life of the security rather than profiting from market price changes. This method involves amortizing any premium or discount over the security’s life, ensuring that interest income is recognized consistently. For example, a bond purchased at a discount would have its carrying amount gradually increased to its face value by maturity, with the difference recognized as interest income. Understanding marketable securities is essential due to their impact on financial statements and overall portfolio performance.

Do you already work with a financial advisor?

They are unrealized because they have not been sold as yet so their value can still change. They are listed at their current market value as they are under the assets section of the balance sheet. Companies earn their revenue by executing the core principles of their business model; they sell a product or service that they believe the wider public would be interested in buying. The company sets a price for this product, which is dictated by supply and demand. If the product is successful and costs are managed well, a company will see profits.

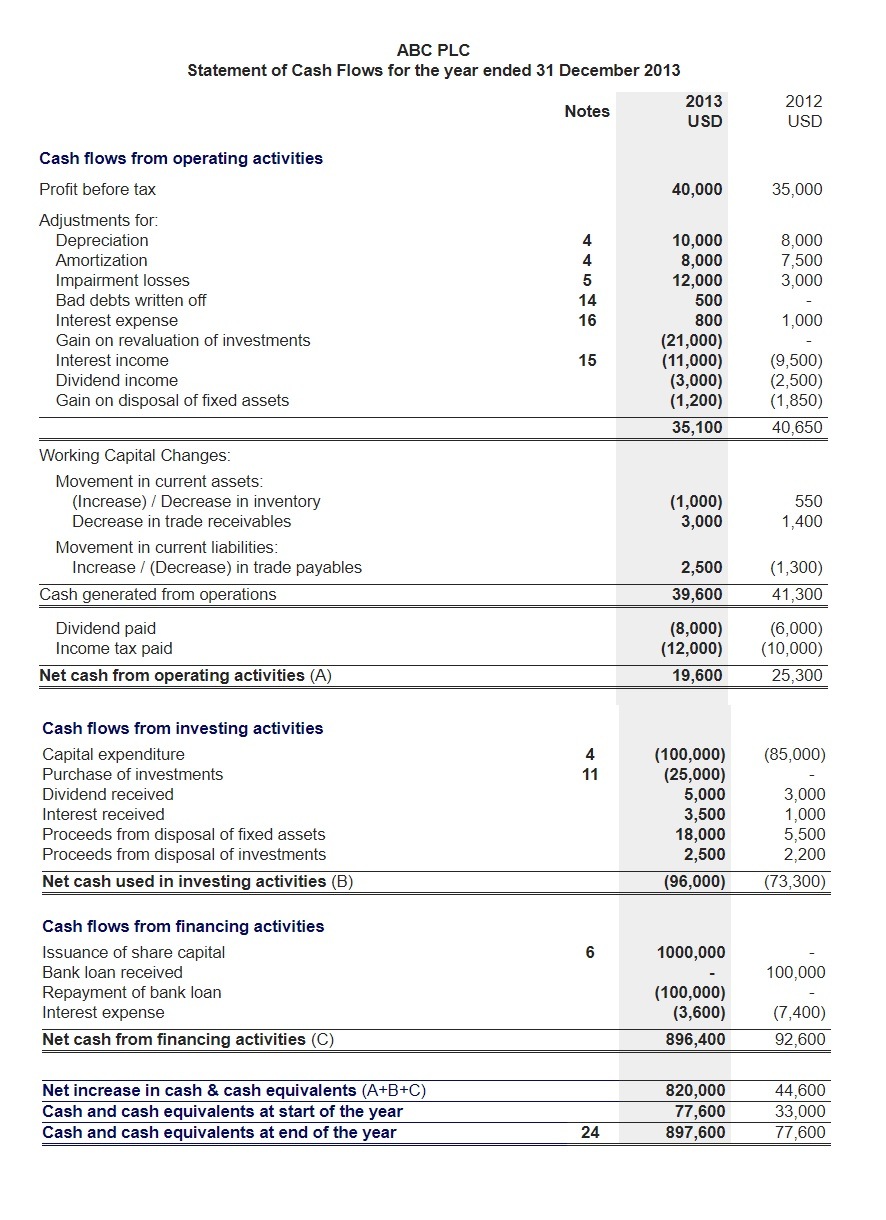

- Cash flow might also impact internal decisions, such as budgeting, or the decision to hire (or fire) employees.

- Meanwhile, it spent approximately $33.77 billion in investment activities, and a further $16.3 billion in financing activities, for a total cash outflow of $50.1 billion.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

- By process of elimination, you can arrive at the conclusion that the Equities section of the balance sheet is the most logic place to include them.

. Gather Financial Statements

Treasury bills are short-term government securities with maturities of one year or less, offering a safe investment with lower returns. Commercial paper, issued by corporations, is used for short-term financing needs. Debt securities are generally considered lower risk compared to equity securities, but they are not entirely risk-free. Equity securities represent ownership in a company and include common stocks and preferred stocks. Common stocks provide shareholders with voting rights and potential dividends, while preferred stocks offer fixed dividends but typically lack voting rights. Investors often seek equity securities for their potential for capital appreciation and dividend income.

Why Is Cash Flow From Investing Activities Important?

The DDM focuses on the present value of expected future dividends, making it particularly useful for valuing dividend-paying stocks. Cash Flow from Investing Activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments during a specific time period. Investing activities include purchases of long-term assets (such as property, plant, and equipment), acquisitions of other businesses, and investments in marketable securities (stocks and bonds). The cash flow statement is one of the three financial reports that a company generates in an accounting period. One of the sections of the cash flow statement is cash flow from investing activities. These can either be positive (cash generated by sales of investment securities or assets) or negative (cash spent on long-term assets, lending, or marketable securities).

Marketable Securities: Types, Accounting, Valuation, and Financial Impact

The company’s financial controller, Mr. Adam Smith, is in a dilemma as to whether those investments are to be classified as these securities or not. Negative cash flow should not automatically raise a red flag without further analysis. Poor cash flow is sometimes the result of a company’s decision to expand its business at a certain point in time, which would be a good thing for the future. The cash flow statement presents a good overview of the company’s spending because it captures all the cash that comes in and goes out.

Marketable Securities In-Depth Guide: What They Are, Valuation, and Impact

Essentially, the accountant will convert net income to actual cash flow by de-accruing it through a process of identifying any non-cash expenses for the period from the income statement. The most common and consistent of these are depreciation, the reduction in the value of an asset over time, and amortization, the spreading of payments over multiple periods. Operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. Investing activities include cash flow from purchasing or selling assets—think physical property, such as real estate or vehicles, and non-physical property, like patents—using free cash, not debt.

In other words, it reflects how much cash is generated from a company’s products or services. A banker’s acceptance is a form of payment that is guaranteed by a bank rather than an individual account holder. Because the bank guarantees payments, this short-term issuance by a bank is considered to be cash. Bankers’ acceptances are frequently used to facilitate transactions where there is little risk for either party.

Most companies hold excess cash as a reserve if needed quickly, such as a possible acquisition or making debt payments if cash flow dries up. Some companies have different goals with their marketable securities, and there are multiple accounting definitions to help investors understand those goals. Hybrid securities, given their dual nature, necessitate a combination of valuation techniques.

It has a net outflow of cash, which amounts to $7,648 from its financing activities. Using this information, an investor might decide that a company with uneven cash flow is too risky to invest in; or they might decide that a company with positive cash flow is primed for growth. Cash flow might also impact internal decisions, such as budgeting, or consignment definition the decision to hire (or fire) employees. Based on the cash flow statement, you can see how much cash different types of activities generate, then make business decisions based on your analysis of financial statements. The income earned from the investments also lists interest or expense from the dividends or interest gained from the securities.

In fact, Apple, which has approximately $104 billion in cash, has the bulk of that cash in marketable securities, with $90 billion of those in stocks, 86% of its cash position in marketable equities. First, the company has far more investments than Microsoft, and as an insurance company, Prudential invests in various different-length assets to match the insurance premiums they collect. The returns are typically quite low as marketable securities are liquid and safe. Below is the cash flow statement from Apple Inc. (AAPL) according to the company’s 10-Q report issued on Nov. 2, 2023.